What Ecosystems Get Wrong About Startups

In today’s startup culture, less than 1% of founders get venture funding. In fact, the numbers say that somewhere between 0.03% and 0.05% of startups receive venture funding. This data comes from research by Haltiwanger Research and Fundera.

Yet almost every startup in the news is about startups raising large venture capital.

If this narrative were true, the startups in our ecosystems would be few and far between. The reality is that venture capital should not be the focus when building a startup ecosystem. Focusing on venture capital too early may hurt the chances of your ecosystem rapidly growing and being able to attract investors in the long run.

These are not new numbers and experienced ecosystem builders know this reality. But why is there such a focus on investment?

Because it is easy. Don’t believe me? Keep reading…

Ecosystem building is slow work—startups often take years to show success. At scale, this leaves builders scrambling to justify their existence, while outsiders see stagnation and focus on the 90% failure rate instead of the wins in progress. Under pressure, builders chase quick wins: bringing in investors, showcasing top startups, and landing corporate introductions. It looks like momentum, funders see fresh venture dollars, and sometimes a few deals close.

Then what?

As mentioned before, less than 1% of startups will ever qualify for investment. In smaller ecosystems, once investors have been introduced to the local startups, they tend to move on. They often complain about a lack of deal flow and begin to view the ecosystem as unviable. Even worse, they’re notorious for sharing this perception with others, reinforcing the belief that the ecosystem doesn’t have enough happening to be worth their time.

Once again, ecosystem builders are forced to justify their existence, often doubling down on efforts to recruit investors. They pour more resources, money, and time into attracting investors from farther away. But when those investors arrive, they usually end up meeting the same startups. If the ecosystem is lucky, a follow-on round happens for a startup that already has backing, or occasionally a new startup has popped up—or matured just enough—to catch an investor’s attention.

Now what? Find Investors Farther Away!

The new investors feel the deal flow dry up, they move on, and the cycle repeats until investors refuse to come to the ecosystem. Even worse, after all of this effort the ecosystem has started to implode. With a 50% failure rate in the first 2 years, the ecosystem may be half the size of where it was. Funders pull their money, local government stops supporting their ecosystem builders, and grants become much harder to come by. Everyone asks, “How is this possible? It was booming just a few years ago!” Even worse, the local community starts to believe that “Startups can’t happen here.”

Investors Stop Responding… We Will Create Our Own!

As it becomes more difficult to attract investors to the ecosystem, many start to focus on starting their own investment funds by activating local investors. They spend time pulling together extremely small funds ($1M-$5M) that attempt to make 20 investments in the local ecosystem. Unfortunately, the numbers still hold true. With only 0.03% – 0.05% of startups receiving investment, it’s unlikely the local fund makes investments. If it does, the bets are riskier, and the odds stacked against the success of this strategy.

If they get lucky, they might try again. But without a shift in approach, the cycle eventually breaks down and investors grow frustrated. Once more, they point to the lack of deal flow as proof the ecosystem is failing. Their attention drifts toward larger ecosystems and outside opportunities until they find enough deal flow to satisfy their fund.

Even then, 75% of all venture funds fail to return a profit. Venture itself is a hard business to get right, and this often fuels resentment toward the local ecosystem that encouraged them to engage in the first place.

Does this Sound Like Your Ecosystem?

This could be so many of our stories as ecosystem builders. It’s a cold reality that many of us rather avoid than face. The challenges in funding, support, and trying to figure out what to do to make an ecosystem successful is very difficult.

So where should we spend our time?

As ecosystem builders, we need to rethink where we focus our time and efforts. Focusing on investment may be a temporary solution to funding and corporate involvement into the ecosystem builder, but focusing too much on this will lead to guaranteed failure of the ecosystem.

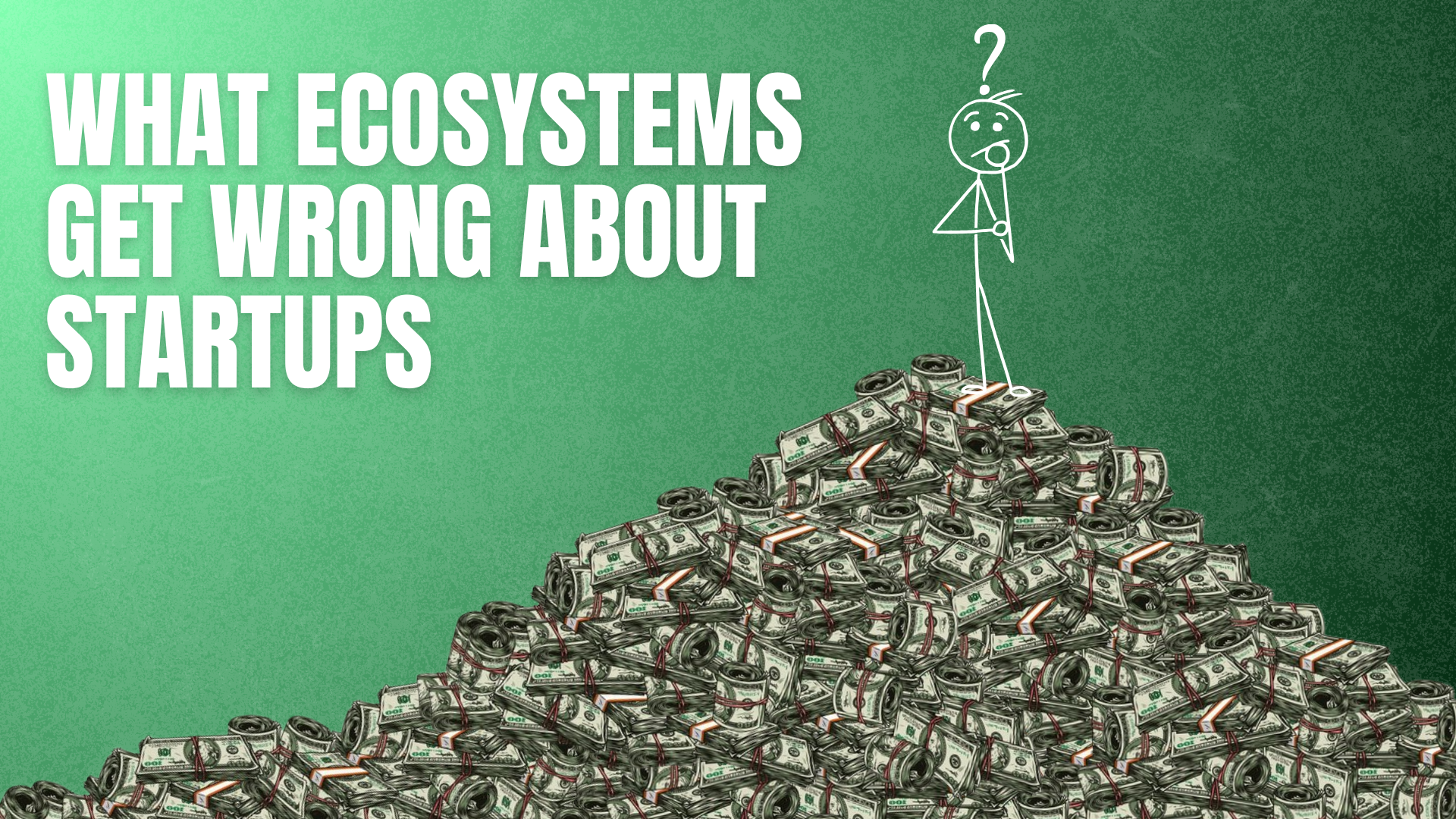

To understand why, let’s break down the numbers of startups and investment. At FoundersForge, we follow what Rob Walling calls the ‘1 – 9 – 90 Rule’.

<1% of startups will receive funding

9% of startups will find alternative capital

90% of startups will have to bootstrap their business

This concept may seem simple, but it outlines the reality of where ecosystem builders should put their time. Each of these categories needs to be approached differently and the time spent on them should be equally proportional to the size of them in the community.

First, focus on cultivating new startups.

Our number one focus should always be on cultivating new startups in our ecosystem. This is the only way to invest in the community and build startups from the ground up. Each time we do this, we can guide founders on a path to success that helps them bypass the avoidable downfalls that come with starting a business. This also increases the size of the startup community which in turn, enables larger deal flow opportunities for investors later in the ecosystem’s evolution.

Working with the 1%

Our focus should be on building strong connections with investors and investment communities, allowing us to introduce them to startups in the ecosystem. As we consistently send quality startups their way and deals begin to happen, a deeper level of trust will form. Even when they reject startups, they should still be impressed with the caliber of candidates we put forward—building the same trust over time.

However, we must be careful. We need to ensure we are making introductions, not cultivating investors to the region. We should be selective on who we spend our time with. The more time we focus on investors the rest of the ecosystem slips.

Activating the 9% – Alternative Capital

Helping startups understand that others will invest is important. Meeting individual Angel Investors and helping startups identify their supply lines for potential investment is important. We recently had a new startup form that needed to build an advanced manufacturing facility.

They were unable to quickly raise money from venture capital because of their focus on a physical manufacturing site, equipment, and more. The time of investment is not as fast as software or other quicker returns. Instead of continuing down the path of traditional VC, they went to their supply chain companies. Everyone from repair companies to parts suppliers. They pitched the businesses and their founders individually. They closed a $45M investment round and opened their facility last year.

The opportunity for alternative capital is huge. Ecosystem builders should have relationships with Community Development Financing Intuitions (CDFIs) and a wide network of business founders in the local community. They should also understand Kickstarter, Start Engine, and community focused support systems of financing. Alternative capital can unlock the doors for many startups in sustainable ways without putting the ecosystem at risk.

Focusing on the Masses.

The reality is that startup ecosystem builders are in the business of the 90% of businesses that fail. Our time needs to be focused on helping startup founders validate their ideas, launch their businesses, and help them have a chance at success. Some of these will surprise us while others may be obvious failures. But, if we can help them understand the process, start successfully, and most importantly, fail gracefully, we will cultivate successful founders that will start multiple companies.

This is a long road and can be difficult to stay motivated with. So many come through our doors and disappear forever. But the ones that stay, the never give up, and continue to impress us every time we check-in with them make it all worthwhile.

This is where we need to spend our time.

Focus on holding programs to start new programs, grow new startups, and provide unique opportunities for the business’s exposure. Find ways to make connections that they couldn’t easily get on their own. Introduce them to capital when they are truly ready for it, but don’t get mad if they go around you. They must forge their own futures to achieve success. It is our job to encourage them to go out and learn, not just succeed.

The investment will come when businesses are truly ready. The investors will come to the ecosystem as they see it grow. They’ll tell their friends, and excitement will flourish around a rapidly growing ecosystem. If anyone could force it to happen, it would be easy to recreate ecosystems. Unfortunately, it’s organic and it takes time.

Brad Feld has said it best from the very beginning. He describes startup ecosystem building as a 20-year journey. After a long and challenging year of building an ecosystem, you get to wake up and realize it’s still a 20-year journey to success. This is the mindset we need to make it happen.